proposed federal estate tax changes

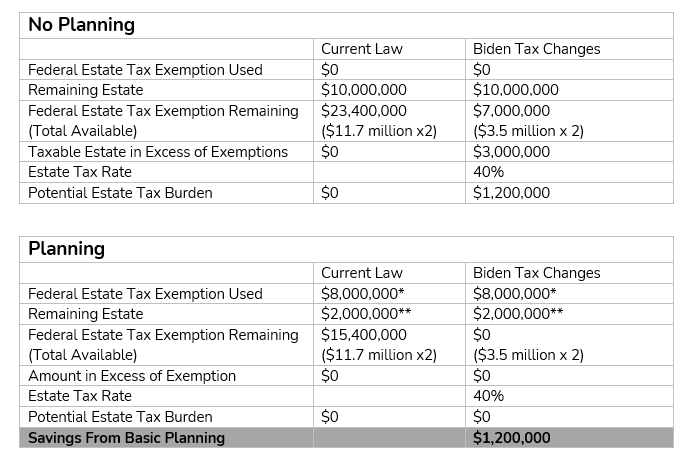

2026 Under the current tax law the higher estate and gift tax exemption will Sunset on December 31 2025. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million.

Do I Pay Tax At My Death Hawaii Trust Estate Counsel

It includes federal estate tax rate increases to 45 for estates over 35 million with further increased rates up to 65 for estates over 1 billion.

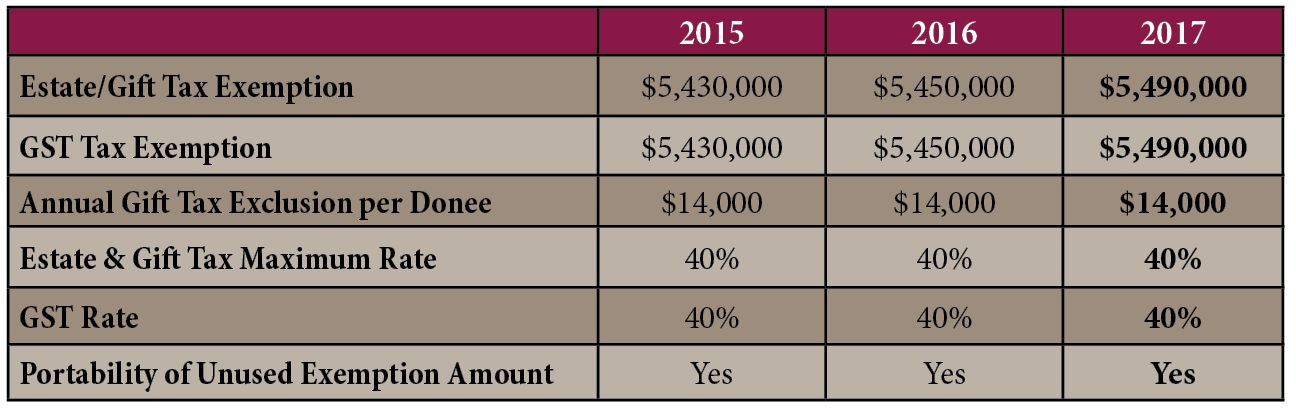

. Federal Estate Tax Rate Under the current proposal the estate tax remains at a flat rate of 40. In addition to the Federal Estate Tax changes the bill raised the top individual tax rate from 37 to 396 increased the capital gains tax rate from 20 to 25 capped the 20. So that makes the total 238 which is still vastly better than 37 or 396.

Whats the proposed change. It could potentially be signed in a different form where the proposed revisions are brought back in. Currently the highest capital gain rate is 20 but you must add the 38 Obamacare tax.

The basic exclusion amount. The tax cuts would. Here is what we know thats proposed.

Another proposal would bring new rules to. Capital gains tax would be increased from 20 to 396 for all income over 1000000. One of the proposals would reduce the estate tax exemption to anywhere between 35 and 5 million with an effective date of January 1 2022.

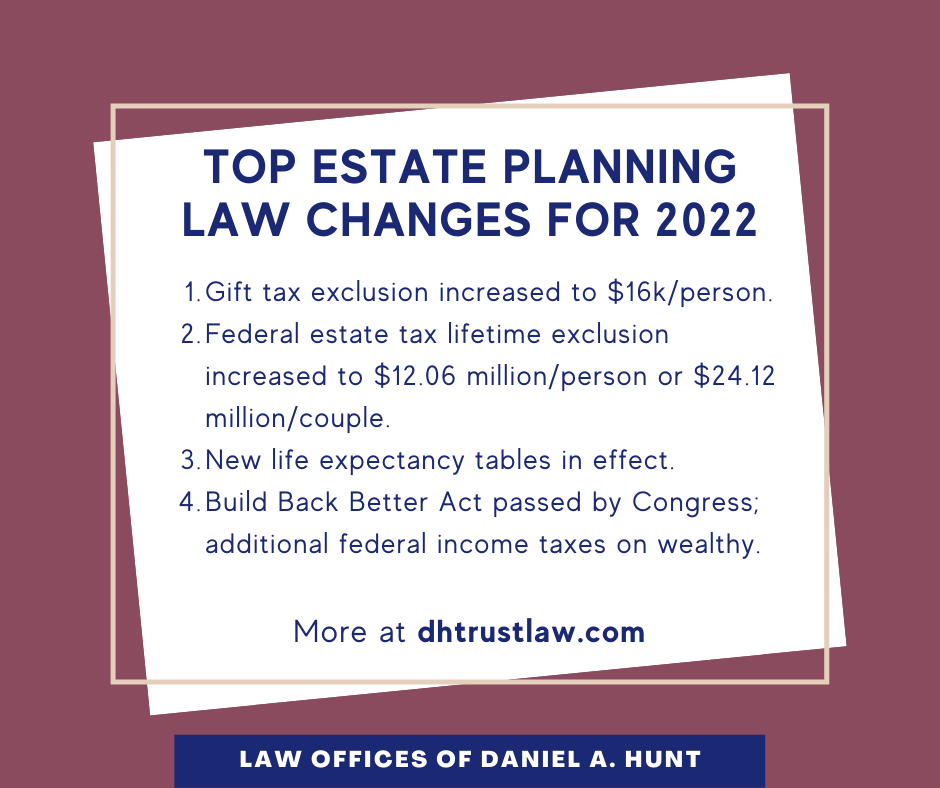

The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million. Net Investment Income Tax would be broadened. We are writing with regard to proposed Federal tax law changes and the impacts they may have on your existing estate plan specifically one or more grantor trusts you have.

The law would exempt the first 35 million dollars of an individuals. Under a Senate Bill introduced by US. Senator Bernie Sanders called the For the 995 Percent Act the lifetime estate tax exemption.

1 day agoLabor opposed the stage three tax cuts heading into the 2019 election but last year reversed its position under Albanese and vowed to keep them in place. Reduction of the estate and gift tax exclusion currently at 117 million to 35 million Imposition of capital gains tax on. Additionally these proposed tax rates would apply to taxable estates worth up to 1 billion.

Second the federal estate tax exemption amount is still dropping on January. On March 25 the For the 995 Percent Act the Act was proposed in the Senate which if enacted would result in the most. Kristen Bennett and Stephen J.

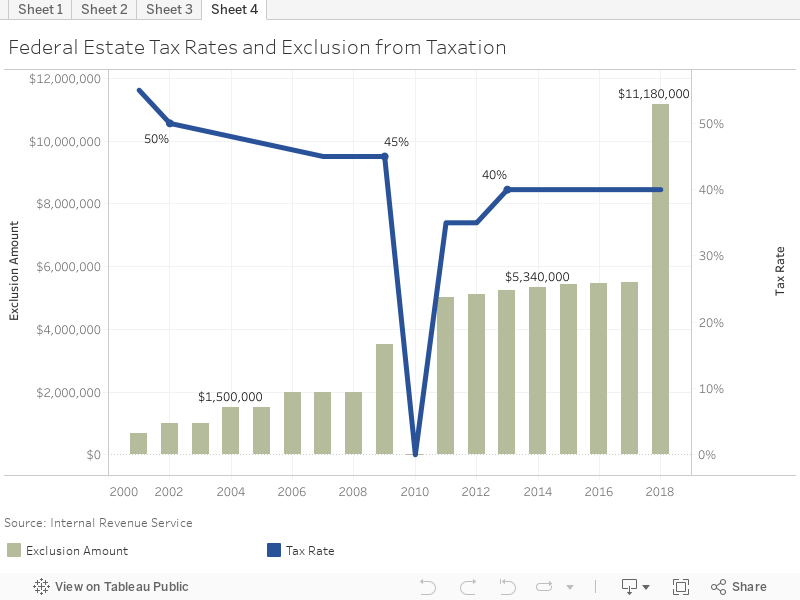

Starting January 1 2026 the exemption will return to 549. Lowering the estate tax exemption The Biden campaign proposed reducing the estate tax exemption to 35 million per person 7 million for a married couple which is what it was in. The top federal income tax rate for estates and non-grantor trusts is currently 37 and the top federal capital gains tax rate is 20.

Reduced Exemption Amount Current 117 million gift and estate tax exemption. Two of the most significant proposed changes include. Proposed Estate and Gift Tax Changes.

Here are some of the possible changes that could take place if Sanders proposed tax changes become law. The maximum estate tax rate would increase from 39 to 65. Lower Gift and Estate Exemptions.

The proposals reduce the federal estate and gift tax exemption from the current 117 million inflation-adjusted for 2021 to 5 million.

Estate And Inheritance Taxes Around The World Tax Foundation

A Guide To The Federal Estate Tax For 2021 Smartasset

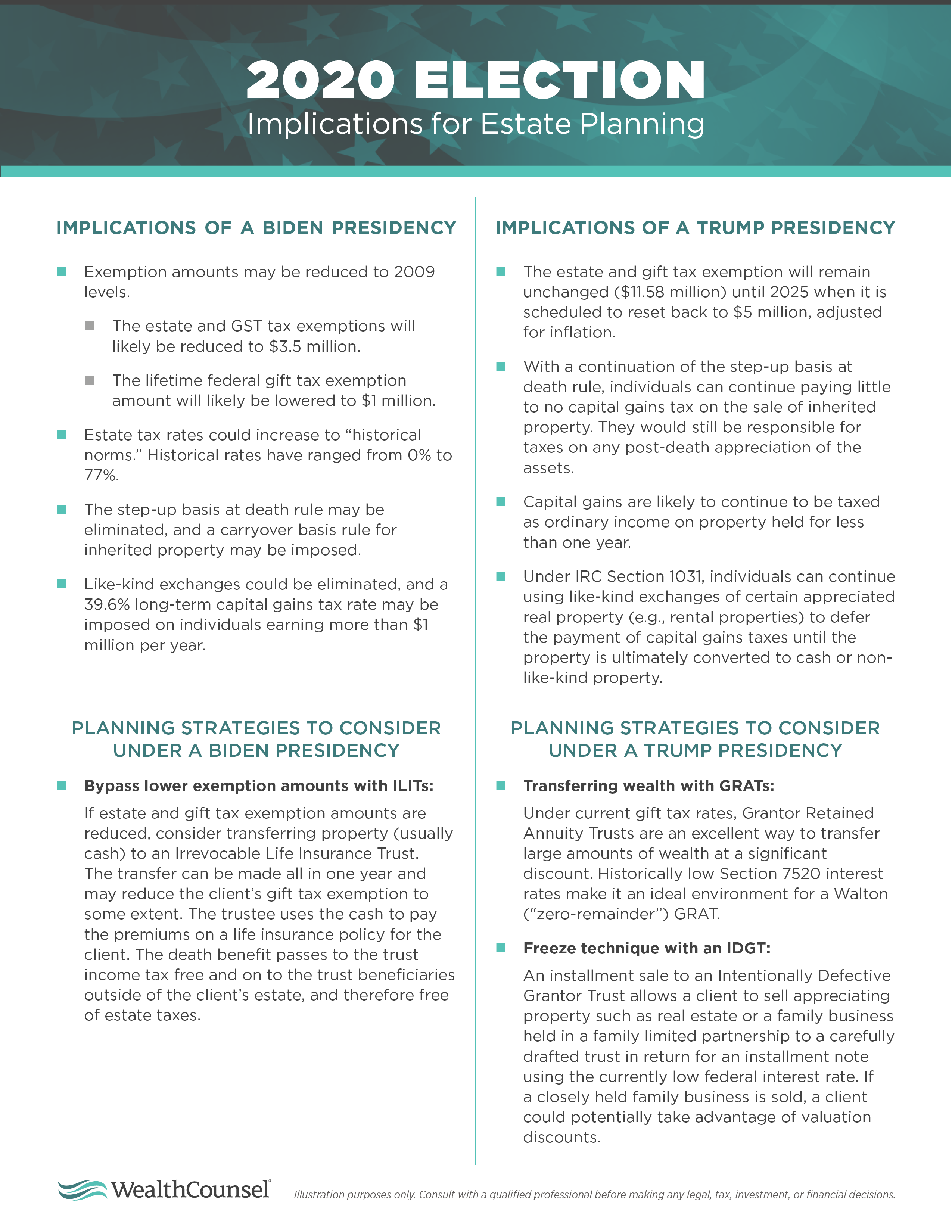

4 Election Year Tax Strategies You And Your Clients Need To Consider

/cloudfront-us-east-1.images.arcpublishing.com/bostonglobe/RWUIN5KCSMYSBRP3CBQGEBG3Y4.jpg)

Spilka Signals Willingness To Deal On Estate Tax The Boston Globe

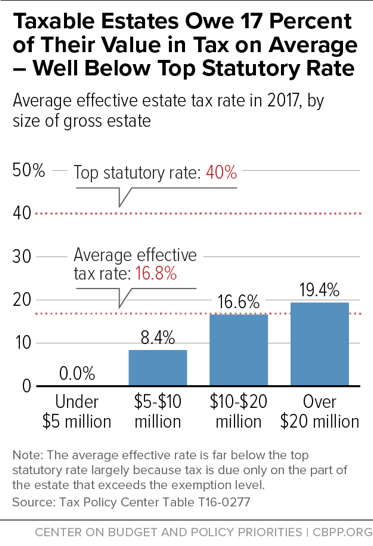

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

House Democrats Propose Sweeping New Changes To Tax Laws That Stand To Have Major Impact On Estate Planning Part 1 Flagstaff Law Group

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Estate Tax Current Law 2026 Biden Tax Proposal

Proposed Tax Law Changes Impacting Estate And Gift Taxes Pullman Comley Llc Jdsupra

Proposed Legislation To Change Estate And Gift Tax Planning Stoel Rives Llp Jdsupra

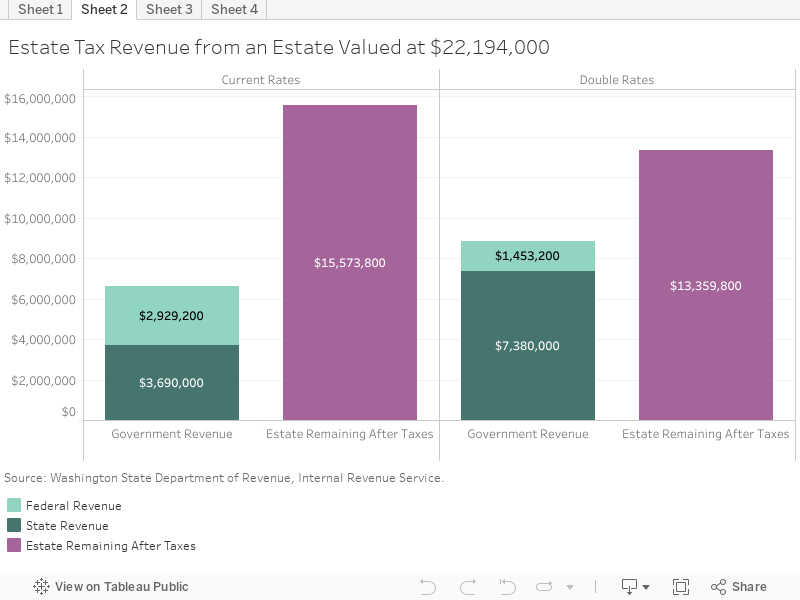

The State Estate Tax A Leveler For Democracy Economic Opportunity Institute Economic Opportunity Institute

The State Estate Tax A Leveler For Democracy Economic Opportunity Institute Economic Opportunity Institute

If The Federal Estate Tax Exemption Is Reduced In The Future Will Your Estate Be Penalized

The 2017 Estate Tax Exemption The Ashmore Law Firm P C

Top Estate Planning Law Changes For 2022 Law Offices Of Daniel Hunt

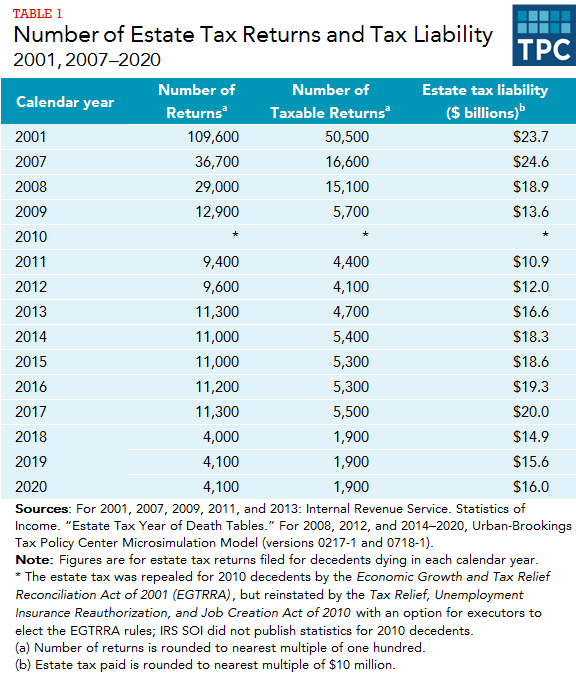

How Many People Pay The Estate Tax Tax Policy Center

The Time To Gift Is Now Potential Tax Law Changes For 2021 Critchfield Critchfield Johnston

Will 2021 See Changes To The Federal Estate Tax Brian Douglas Law